A positive signal about Vietnam’s forest product exports in the first 6 months of 2021

T2,Tháng Bảy 19,2021

Vietnam’s forestry and wood industry show a comprehensive growth in the first 6 months of the year

According to Vietnam Forestry Administration (VNFOREST), in the first 6 months of 2021, about 658 million seedlings of all planting species have been propagated to meet the national planting plan defined for 2021. The area of newly planted forest is 108,258 hectares, reaching 41.6% of the year plan, equal to 122.3% over the same period of 2020. In particular, under the project of planting 1 billion trees, over 48.5 million scattered trees have been planted.

At the mid of 2021, sustainable forest management certificate has been granted to 306,726 ha of forest (including both FSC and VFCS/PEFC certificate schemes), of which the forest area certified by the VFCS (Vietnam Forest Certificate Scheme) is 55,002 ha. In the first 6 months of the year, the certificates have been issued for over 38 thousand hectares with the total area of newly certified forests for the whole year targeted at about 100 thousand hectares.

In forest protection, forest-fire and forest-violation prevention has achieved encouraging result. The number of detected violations was reported at 1,329 cases, showing a decrease of 114 cases (down 8%) compared to the same period of 2020. VND 29.5 billion (about US$ 130) was fined on these violators. The area of damaged forest is reported at 1,210 ha, minus 1,380 ha (53% down) compared to the same period of 2020. In particular, the area of forest destroyed by fire accounted for 283 hectares, while the figure of illegal deforestation is 672 hectares.

The volume of timber harvested from concentrated forests is 6.8 million m3, equal to 32% of the year plan and 114% over the same period in 2020. The export value of wooden and non-wood forest products in the first 6 months of 2021 amounted to US$ 8.71 billion, up 61.6% over the same period in 2020, including wood export US$ 1.76 billion, up 23.6%; wood products US$ 6.35 billion, up 75.4%; non-wood forest products US$ 0.6 billion, up 72.9%. It is forecasted that in 2021, the export revenue of W&WP plus non-wood forest products will record at about US$ 15.5 – 16.0 billion, showing a year-on-year growth of about 17 – 20%.

The import of W&WP in the first 6 months of 2021 recorded at US$ 1.54 billion, up 39% over the same period of last year, in which the import of wood in the form of raw materials was US$ 1.15 billion USD, up 10.8%; wood products $0.389, up 476.1%.

The income from the payment for forest ecosystem service (PFES) has increased by 67% over the same period of 2020. VND 1,431.7 billion (about US$ 65 million) was collected through PFES. Most of this money is distributed to upland dwellers to remunerate their contribution to catchment/watershed forest protection.

Source: Tổng cục lâm nghiệp (tongcuclamnghiep.gov.vn)

Made-in-Vietnam wooden products conquer US market

Boasting huge production advantages and capitalising on good market opportunities, Vietnam’s furniture sector has stood firm amid COVID-19 and improved its position in the global market and especially in the US.

Insiders, however, have said that in order to gain the lion’s share of the market and maintain its standing, the sector needs to adopt more effective measures to help Made-in-Vietnam products meet international standards on sustainable development.

Moving ahead

Vietnam has overtaken China as the largest exporter of wood furniture to the US, according to the US-based Furniture Today website.

Despite the trade disruptions, the country shipped over 7.4 billion USD worth of furniture to the US last year, up 31 percent compared to 2019. By way of comparison, China’s export value was 7.33 billion USD, down 25 percent.

While the gap is relatively small, Vietnam’s position on the world stage reveals how it has grown in importance over the years.

A more dramatic shift has occurred over the past two and a half years, after the US Government imposed tariffs as high as 25 percent on almost all furniture categories exported from China, encouraging many manufacturers to move away from the country.

In a recent online conference with Vietnamese businesses, US distributors said that since the US Government slapped tariffs on Chinese furniture they have sought new suppliers and Vietnam is the leading choice.

Most furniture for bedrooms, kitchens, and offices now comes from Vietnam, they added.

Sales of Vietnamese wooden products have enjoyed robust growth over recent years and the US would import more Vietnamese furniture if not for COVID-19.

According to Tran Lam Son, marketing director and quality manager at the Thien Minh Production Trading Export Import Company Limited, in previous years, international buyers rushed to China in March and April to study their wooden products and place orders. Vietnam, meanwhile, was their second choice.

This year, Vietnamese furniture is more preferable, he said, adding that the country has substantial opportunities in the US, where the housing market is on the rise.

Sustainable development a necessity

Becoming a leading furniture supplier to the US is a major opportunity for Vietnam to promote the production of wooden items, but manufacturers must meet requirements regarding sustainable development and guarantee their timber is of legal origin, experts have said.

Chairman of the Dong Nai Association of Wood and Handicrafts Le Xuan Quan said Vietnamese associations need to take drastic action to raise awareness among local businesses about the significance of following international rules and standards.

The State, meanwhile, should outline mechanisms to control input materials, shadow investments, and identify tax evasion activities, he said, saying that these are crucial for Vietnam’s wood sector to sharpen its focus on market development and affirm its existing position.

Several firms, he pointed out, have faced anti-dumping petitions from the US and the Republic of Korea and been accused of using illegal timber sources.

There was a time when Chinese-made exports masqueraded as Vietnam-made goods, threatening domestic production and legitimate exports, he stressed.

Julie Hundersmarck, a Programme Specialist at the US Forest Service, said that the US market is opening its doors wider to Vietnamese furniture exporters, adding that relevant authorities in the US have deployed various tools to ensure exporters comply with legal timber rules.

Experts also noted that Vietnamese firms need to prevent origin fraud, since the US is a large and strict market in terms of trade fraud and tax evasion./.

Source: Made-in-Vietnam wooden products conquer US market | Business | Vietnam+ (VietnamPlus)

Vietnam becoming the second largest exporter of woodpellet

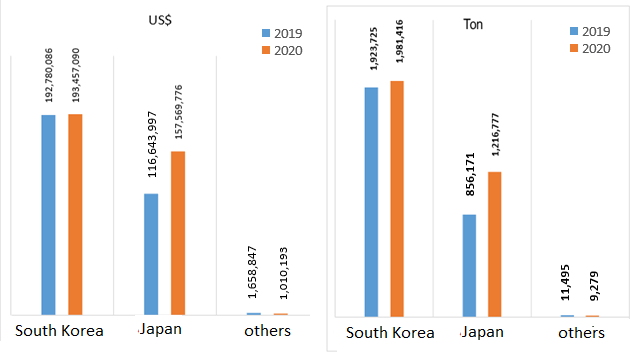

Following the US, Vietnam has become the second largest producer of woodpellet. In 2020 Vietnam exported 3.2 million tons of woodpellet mostly to Japan and Korea for power generation. In the period from 2013-2020, exports increased more than 18.2 times from about 175.5 tons to 3.2 million tons; export value increased more than 15.3 times, from nearly $23 million to $351 million.

According to EPN, the world demand of woodpellet continues increasing at about 250% in the next decade, reaching 36 million tons from 14 million tons in 2017. EU, Japan and South Korea are the top consumers of this wooden product. Vietnam’s woodpellet industry is targeted at these markets.

Viertnam’s woodpellet production and export

The decrease in export prices may be partly due to the increasing number of enterprises involved in production. The record of the General Department of Customs shows that in 2020, there are 74 enterprises participating in export, up slightly from 72 enterprises in 2018. In 2020, the number of large-scale exporters (export volume over 50,000 tons / enterprise) is 17 enterprises, equivalent to over 23%). The number of medium-sized enterprises (export volume from 20,000 – 49,000 tons / enterprise) is 10 enterprises, accounting for 13.5%, the rest are small enterprises (less than 20,000 tons / enterprise). Figure 4 shows the number of exporters by size in 2020.

According to VIFOREST, Vietnam currently maintains 74 woodplellet factories with the total production capacity of about 4.5 million tons per year. At present, the raw material used by these factories are mostly sawdusk and wood wastes collected from a large number ò să mills, veneer and furniture making facories.

Volume and value of woodpellet exported from Vietnam

Woodpellet price

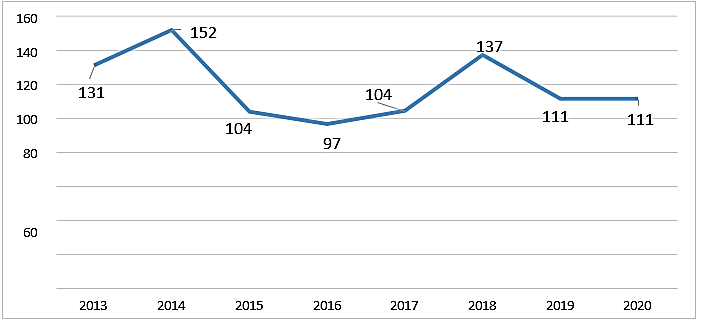

Figure 2 below shows the flagtuation of woodpellet price 2013 – 2020. In 2013 when Vietnam started woodpellet production and export, price of this wooden product was US$ 131/ton. The price of woodpellet surged in 2014, dropped down bellow US$ 100 in 2016, restored to Ú$ 137 in 2018, and stood at US$ 111 in the last 2 years.

Figure 2: Price of woodpellet esported from Vietnam (FOB, US$/ton)

Woodpellet export markets

South Korea and Japan are topping consumers of woodpellet exported from Vietnam.

Figure 3: Volume and value of woodplette export by markets